Mortgage Management Programme

| 2 Days Course |

| SkillsFuture Credit Eligible |

| UTAP Eligible |

Course Overview

This 15-hour course is perfect for anyone who is considering purchasing a home or interested in learning more about the mortgage process in Singapore. It is ideal for first-time home buyers who may be unfamiliar with the terminology and requirements associated with obtaining a mortgage. By providing a comprehensive overview

of the mortgage process and equipping participants with the tools to make informed decisions, this course can help individuals confidently navigate the home-buying process.

Whether you are in the early stages of considering a home purchase or actively searching for a property, this course is an essential resource for understanding mortgages and securing the right financing for your needs.

More Investment and Trading Courses →

Course Title

Mortgage Management Programme

Course Highlight : Mortgage Management Programme

- -Factors of Property Valuation – Learn what factors affect the value of a property

-Learn from Industry Experts – Experienced instructors with a real-life experience in the mortgage advisory field

-Avoid Mortgage Penalties – Understand when penalties are incurred and the possible escape clauses

-Find the Best Way to Finance Your Home – Understand how to evaluate mortgage options and calculate payments

-Loan Structuring – Learn how to choose the best type of loan for your situation and how to pay it off in a timely and feasible manner - Gain a Comprehensive Understanding – Our curriculum covers all aspects of the

mortgage process

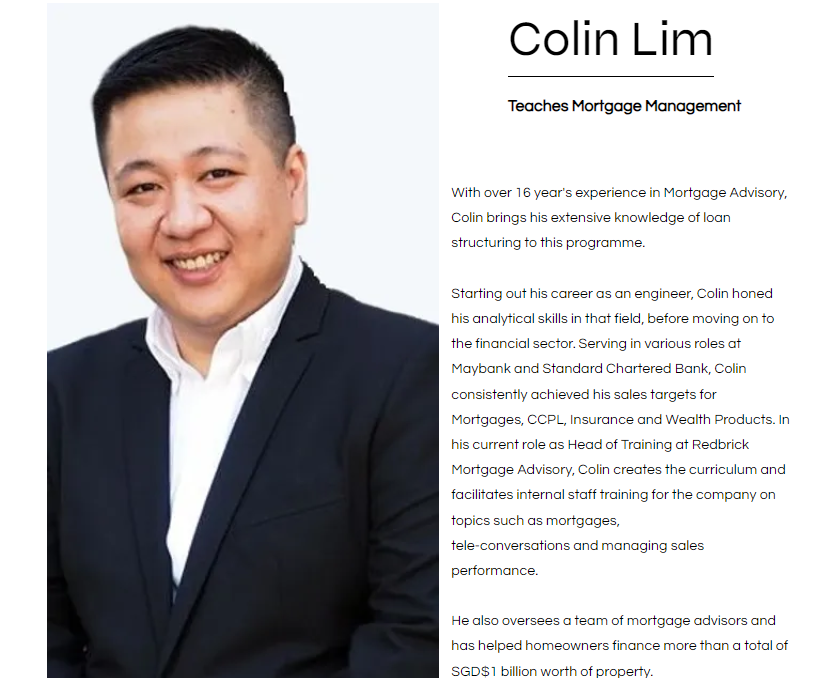

Trainer Profile

Mortgage Management Programme

Course Content: Mortgage Management Programme

- Introduction to different Residential Properties

Manner of Holding a property - Valuation

- Customer Requirements

- Interest Rates

Penalties of Mortgage Loans

Escape clause for such penalties - Taxation of client in property purchase

Property Tax

Buyer Stamp Duty

ABSD Remission - Understanding Loans

HDB Home Loan vs Bank Loans

Legal and valuation fees - Basic Loan Structuring

Purchase Breakdown

IWAA

MSR

TDSR

Income - Sales Process on client journey

- AIP and eligibility calculation

- Refinancing savings calculation

- Loan application & list of documentation required

- Loan Structure Worksheet

- Loan Acceptance

- Loan Engagement

Who Should Attend

- First-time Home Buyers in Singapore

- Those interested in Real Estate Investments

- Anyone interested in learning more about the Mortgage Process in Singapore

Pre-Requisites

- Basic english skills (reading and writing)

- Basic computer skills (downloading files, using Zoom, etc)

Certificate

Participants who complete the course and all required assessments will receive a Certificate of Completion by the Approved Training Provider.

Course Feature

Course Feature

Course Provider: Unicorn Financial Solutions

UEN: 200501540R

Course Reference Number: TGS-2023019716

Mode Of Training:

Funding Validity Period: N/A