What is CPD — Continuing Professional Development ?

CPD — Continuing Professional Development, is a nation-wide scheme that was introduced to ensure that industry representatives and practitioners maintain knowledge and skill currency with regulatory and industry changes. Essentially, it allows industry professionals to evolve in tandem with the industry. In this article, we will examine and summarize the various CPD requirements of the Financial Industry.

How is CPD qualified and tracked?

CPD Qualification

Every financial industry practitioner has a quota of CPD Hours (a.k.a. CPD Points) that they need to acquire on an annual basis. In some instances, these hours are differentiated into Core Hours and Supplementary Hours. These hours/points can be obtained by doing a few types of activities, such as:

- Training & Education

- Instruction

- Leadership

- Research & Publication.

In this article, we will elaborate on the CPD Hours that can be clocked from Training & Education courses. For training courses, core hours and supplementary hours are differentiated in that:

- Core hours have a higher quota than Supplementary hours

- Core hours are accumulated by participating in programmes that are related to the practitioner’s field of financial work; Supplementary hours do not require the programmes to be related to the practioner’s field of work

CPD Tracking and Enforcement

Fulfilments are tracked annually. Depending on whether you are from the private or public sector, the principal entity which oversees the tracking of your hours will be your employer/a dedicated entity in your organisation, or a dedicated entity in IBF, respectively.

Do note that simply completing the course will not complete the fulfilment process — you will need to submit the relevant course documents to your organisation’s principal entity that is overseeing everyone’s hours.

What are the Different MAS Financial CPD Schemes?

IBF Standards CPD

Who It Applies To

The IBF Standards Scheme applies to all IBF Certified Individuals. You will need to meet your annual quota in order to retain your IBF Certification.

CPD Hours Required

All IBF STS (Standards Training Scheme) and FTS (Financial Training Scheme) funded courses will contribute to this scheme’s requirement.

- 15 hrs annually — Commences from the calendar year after the year in which the individual was certified

Other Requirements/ Information

Annual CPD Activities must be directly relevant to the financial industry. The relevant activity categories are:

- Ethics / Market Conduct Requirements

- Product Knowledge

- Skills / Competencies

- Rules and Regulations / Compliance-related matters

Monitoring Process

The IBF Certified Individual is required to maintain and submit supporting documents (e.g. certificate of attendance/ completion, appointment letter or copy of published article etc.) for all CPD activities undertaken and records on how the required hours are met. These documents are required for IBF audits on the individual to ensure all IBF CPD requirements are met.

In addition to acquiring the respective programme certificates, the individual has to submit the documents to IBF as well. Where submission is not complete, certification status will not be awarded.

For more information on the requirements for this scheme, click here.

Financial Advisory Representatives CPD

Who It Applies To

The Financial Advisory Representatives Scheme applies to all appointed representatives of Financial Advisers, except first-time appointed representatives who are still within the same calendar year of their appointment.

CPD Hours Required

For representatives who provide advice or arrange contract of insurance in respect of mortgage reducing term assurance policies and/or group term life insurance policies:

- Core hours (IBF/SCI-accredited programmes in respect of Ethics, or Rules & Regulation, or both): 6

- Supplementary hours: 10

For representatives who provide advice concerning any investment product, marketing of any collective investment scheme and arranging contract in respect of life policies:

- Core hours (same as above): 6

- Supplementary hours: 24

Monitoring Process

Financial Adviser company must appoint a principal entity to monitor representative CPD quotas. These principal entities will:

- Calculate the total number of completed structured CPD training hours of each of its appointed representatives as at the end of each calendar year, and

- Maintain a register containing records of each of its appointed representatives’ total number of completed structured CPD training hours for each calendar year, and the principal entity must retain the register for a period of not less than 5 years from the end of the calendar year in which the appointed representative is appointed

For more information on the requirements for this scheme, click here.

Client Advisor Competency Standards CPD

Who It Applies To

The Client Advisor Competency Standards Scheme applies to all Covered Persons. It is not applicable to Covered Persons who have attained IBF Certification less than 2 years ago.

What is “Covered Person”, “Covered Entity” and “AIs”?

- Covered Person — an individual who is in a client-facing role and provides financial/wealth advisory service(s) to AIs (accredited investors) on behalf of a Covered Entity.

- Covered Entity — a financial institution or a division thereof which is regulated by the MAS, where the financial institution or division provides services to AIs.

- Accredited Investors — accredited investors are investors who have access to a wider range of investment products than non-accredited investors, and at the same time require less regulatory protection. To qualify, certain requirements must be met.

CPD Hours Required

There is a minimum requirement of 15 hours annually:

- 8 hours minimum in training that is accredited under IBF-STS in Private Banking and Wealth Management or Generic Skills and Competencies

- 4 hours minimum in training related to Rules & Regulations, Compliance or Ethics

- Special Case:

- Covered Persons with less than 3 years of experience as Relationship Managers (as of 31 December 2018) must complete minimum of 15 hours in training that is accredited under the IBF-STS and attain IBF Certification in Private Banking within 3 years from the date of implementation.

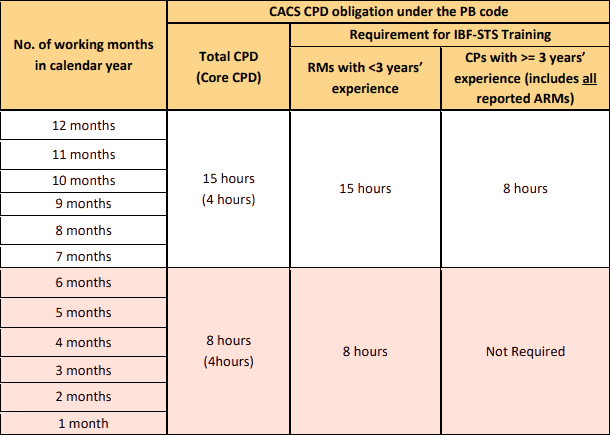

Do note that New Covered Persons or individuals who have worked for 6 or less working months in any calendar year may qualify for a prorated CACS CPD obligation for that year, as shown below. Any unfulfilled CPD hours for that year may be carried forward and completed in the next calendar year.

Monitoring Process

Covered Entities are expected to submit CPD fulfillment reports for their Covered Persons annually, by 31st Jan of the following year. Go to the IBF Portal Login, where you can submit annual CACS CPD reports for your entity.

For more information on the requirements for this scheme, click here.

Capital Markets Services Representatives CPD

Who It Applies To

The Capital Markets Services Representatives Scheme applies to representatives of Capital Market Services (CMS) License holders and Exempt Financial Institutions.

CPD Hours Required

The number of core and supplementary hours required are as such:

- Core hours (IBF-accredited programmes in ethics or rules and regulations or both, as the case may be, which is relevant to the type or types of regulated activity he carries out): 6

- Supplementary hours (in relevant training courses): 3

The following representatives have CPD quotas that differ from above:

- Individuals who are appointed as representatives for the first time, for their first calendar year, do not need to clock any CPD hours.

- Individuals who are appointed representatives for an aggregate period of less than a year in a calendar year, will complete a pro-rated number of core and supplementary CPD hours (direct percentage)

- If unable to reach their pro-rated quota, they can carry over the remainder to the following year at maximum

- If they change their principal in the new calendar year, they will not need to complete the previous year’s unfulfilled CPD hours that were accumulated under the previous principal

- If they cease being an appointed representative, they will not need to complete their total pro-rated core and supplementary CPD hours

Monitoring Process

Principal entity must monitor representatives’ CPD quotas. They will:

- calculate the total number of completed structured CPD training hours of each of its appointed representatives as at the end of each calendar year, and

- maintain a register containing records of each of its appointed representatives’ total number of completed structured CPD training hours for each calendar year, and the principal entity must retain the register for a period of not less than 5 years from the end of the calendar year in which the appointed representative is appointed.

For more information on the requirements for this scheme, click here.

If you are interested in clocking some CPD Hours, you can check out our range of Investment Courses.